A new documentary recently came out on Netflix called The Social Dilemma. I highly encourage you to watch it. After I saw it, I began to reflect deeply on how social media is everywhere and it is really tough to get away from it. I also thought about how social media intersects with personal injury law — the area of law that I specialize in, where I have the majority of my experience.

I thought that now would be a good opportunity for me to offer my take on social media in personal injury law cases, from an attorney’s perspective. Although I’m writing this article with my law colleagues in mind, I’d like to emphasize that this article is intended for everyone else — the general public. Regardless of whether you’ve been in an accident recently, it’s important to remember the impact that social media participation can have on a legal case.

Social Media in the Discovery Process

There is a rule in every state where a lawsuit is filed that allows the opposing party to request disclosures. The umbrella term for this is discovery — where parties engage in trading information.

In personal injury law, as a part of the discovery process, it’s common for the opposing party to ask for a disclosure about the injured party’s social media accounts.

Many people do not realize this. In fact, you might be wondering Why would my Facebook page have anything to do with my case?

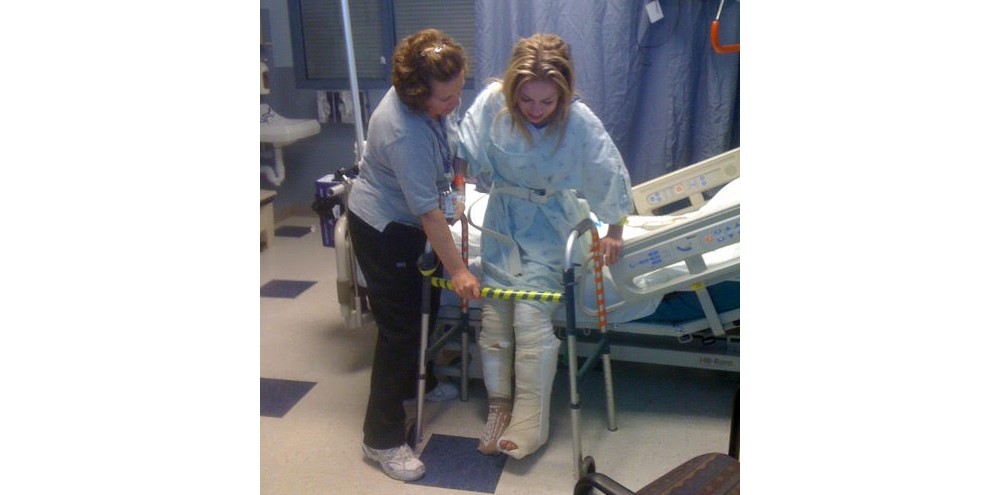

Here’s why: Imagine that you’re in a personal injury case. To prove that you have been injured, your attorney may be required to disclose medical records and related documents, in an effort to illustrate the severity of these injuries.

Character witnesses might be called upon, as well. These are the people who can talk about how well you were before the accident and how you are today, after the accident. An example would be Jonathan’s friend saying the following:

This is a statement that is better coming from a character witness than from the injured plaintiff. In my own experience as an attorney, I’ve noticed that it’s better to have a third party explain changes in the injured person’s activities.

Let’s think about this from the standpoint of the defendants in a case — not just the other person named in a case, but also with that person’s insurance company, defense attorney, and potentially others. The defendants can ask for information in an effort to verify statements made about injuries and the effect of those injuries had.

What people don’t realize is that defendants can request information, through discovery, that includes social media. After all, where are people most active about their daily lives? On social media!

Social Media Extends Further Than You Might Think

In personal injury cases, attorneys need to be careful and ensure that their clients are, in fact, really losing their ability to perform activities. You would not want to be in the situation that Negretti & Associates faced a few years ago, when our client told us, “I love hiking. But I can no longer hike because of the injury to my leg.” But, as we looked at the client’s Facebook pages, we saw bunch of hiking photos spanning the last few months. As a plaintiff’s attorney, this sort of thing makes your client look terrible. They lose all credibility.

The growth of social media has exploded in a billion fragmented directions, touching every aspect of daily living. Yet, it goes far beyond more than just the few sites or apps that we might think of off the top of our heads, such as Facebook, Twitter, and Instagram. Attorneys should consider every possible “social” profile that a client might have.

Consider these examples:

- If you are currently single and you’re dating, your dating apps could be considered social media. If you have a profile on a dating website or app like Tinder, and it talks about things that you enjoy doing and things that you can do, it would be odd to testify in your case that you can no longer go dancing. But your dating app that says one of your favorite activities is dancing. These two things do not match and that is not good if you are going to bring a claim for a loss of an activity like dancing.

- Imagine that one of your favorite activities is cooking and baking. You enjoy sharing images of your newest creations and explaining how you fine-tuned your recipes. If you say you can no longer cook, or you have lost your love for baking, your active Pinterest use can work against you. Be honest about how you’ve been affected.

- If you like to ride your Peloton bike at home using the Peloton app, this can fall within the boundaries of social media, as well. You may ride with a lot of your friends on Peloton, accept their challenges, and participate in all of the good-natured fun that comes along with competition. However, if you’ve been injured and you’re telling the defendants that you can’t ride your Peloton anymore because of pain or discomfort, then you probably shouldn’t be on the Peloton app, and you shouldn’t be logging rides. If you can ride, then don’t say that you can’t ride.

- LinkedIn, even though it’s business-related, is still social media. If you’re claiming that you have cognitive deficits — you’ve seen a neurologist, you’ve been diagnosed with a traumatic brain injury, you’re receiving treatment, you’re not able to see straight, and you are constantly frustrated with headaches — but you’re all over LinkedIn, posting different articles or sharing information to help fellow colleagues, those two things may not match up that well in your case.

Whether you’re a personal injury attorney or someone who is involved in an accident, it’s not a good look to be stating that you’ve lost the ability to do certain things and tell the opposite story on social media. If you really have been injured, then your social media should match those claims. Our advice would be: don’t be on social media during your personal injury case. Things can be misconstrued and misinterpreted.

Honesty Is the Best Policy

Ultimately, personal injury attorneys want their clients to be honest about how their accidents have affected their lives.

I’m a plaintiff’s attorney through and through, with every ounce of blood in my body, but I am not about people lying, and I’m not about people overstating what’s going on with them.

People lying and overstating their injuries are part of the reason that conspiracies have evolved in our industry — that every plaintiff is a liar and insurance companies never want to pay. A cyclical, self-reinforcing dynamic, between plaintiffs and defendants has grown over time:

- Every defense attorney who I’ve ever talked to thinks that every plaintiff overstates his or her injuries and losses.

- Meantime, simply because plaintiffs have overstated their injuries and overplayed their hands, insurance companies have become trained to believe that everyone does this.

- Because insurance companies do not want to pay someone fairly for what has happened to them — even if the injured person is being completely reasonable — plaintiffs feel like the industry is out to get them.

What can an attorney do to break this cycle and debunk myths about exaggerating injuries and losses?

Be more transparent. You have to be willing to share information if you are going to take your case into litigation.

In personal injury law contexts, I have encountered extreme viewpoints about social media. Some have the impression that it’s best to go completely dark, in order to eliminate any possibility of having to disclose their social media postings. This is along the same lines of thinking as keeping Alexa out of one’s house, because we know Alexa is listening. Others may feel a need to be more reserved about their injuries in social media, in an effort to not overstate or overplay them.

Here’s what I would say: Just be honest about your injuries. If you’re injured, you’re injured. If you can’t ride your Peloton bike, then don’t ride your Peloton bike. If you can’t bake, or don’t want to — because you injured your hand, it hurts too much, and there are too many accommodations that you have to account for — then you probably shouldn’t be pinning your cooking photos to Pinterest.

Before you post something to social media, ask yourself the simple question: Would this look okay to someone else who may be evaluating the sufficiency or the seriousness of my injuries?

Remember, if your injury has prevented you from doing something, your claim has to be proven in some way. You have to prove your injuries by providing evidence. That’s the only way that the trier of fact — the jury that all of us get to be a part of — is ever going to believe that you really suffered those injuries.

Social Media Disclosures for New Cases

At Negretti & Associates, we have a social media disclosure document that we require all clients to sign at the beginning of their cases. It simply states that we are advising you to stay away from social media while your case is ongoing, so that you don’t send a red flag to the defendants that they should be looking into your social media accounts. If you do that as an attorney, it puts you in a much better place.

Granted, there may be some instances where the client has already made posts about their accident and resulting injuries. In these cases, we advise clients not to delete their posts, because that could be considered destruction of evidence.

One possible solution is to make your account private. There’s nothing wrong with doing that. Remember, if insurance companies and defendants as a whole figure out that you have these channels, they can certainly request them through that process of discovery. You can help to avoid this by making your account private.

Likewise, we encourage clients not to “friend” new people during the pendency of their claims. When accounts are private, avoid granting profile access to unknown users. This avoids the risk of friending people that could be part of the defense team.

There are now companies that can be hired to run social media backgrounds on people that make claims on injured victims. I’ve seen the reports. They are comprehensive. It may not just be an insurance adjuster who’s digging around trying to find information on your Facebook. It certainly could be an entire team of people who are looking into every aspect of your life — including this blog.

I hope this information benefits my clients, and in no way causes any sort of distraction or disruption in their ability to bring a claim.

Bottom line, if you’ve been involved in an accident and you’ve suffered a personal injury, be aware that social media is far more encompassing than you probably think it is.